Appraisal Review

I am giddy today!

I have had a productive week, and we got word today that our appraisal came in at our purchase price, woo hoo!!

To back up a little bit, let me tell you a little more about the appraisal contingency and what that means.

When making an offer on a home, you can offer Cash – meaning you have the funds available, or you can finance the home – a Mortgage. Cash is typically very desirable for sellers because there are less obligations to be met and less things that can “fall apart” during the contract phase. There are several options for home mortgages, most of which require that home has an appraisal. When a home is being financed, the lender (bank), wants to be sure that the investment (home) is actually worth the amount of money they will be putting up for the purchase so that if something were to happen, and the loan was not paid back, their investment would compensate them for that loan.

In this specific case we are using a VA loan and financing 100% of the purchase. That means the home must be worth at least the full amount of the purchase price. In an incredibly competitive market, it can be very nerve wracking waiting for an appraisal because urgency, demand and desperation of buyers can sometimes drive offers over the value of what the home may be worth. If the appraisal came back below the purchase price the buyers would have to either provide the difference in cash or try to negotiate with the sellers to lower the original offer price down to the appraisal, or at least closer. If an agreement cannot be reached, the contract would fall through. The sellers would have to go back on the market or to their back up offer, and the buyers would have to start their home search all over again. That is not something that anyone would want at this point – but it does happen.

Happily, for us, the value matched the purchase price, and the lender will fund the entire purchase, so we are clear to move forward!!

We are just 2 weeks to close and have met 99% of the requirements of the lender. With one more document to go, and it is on the way!

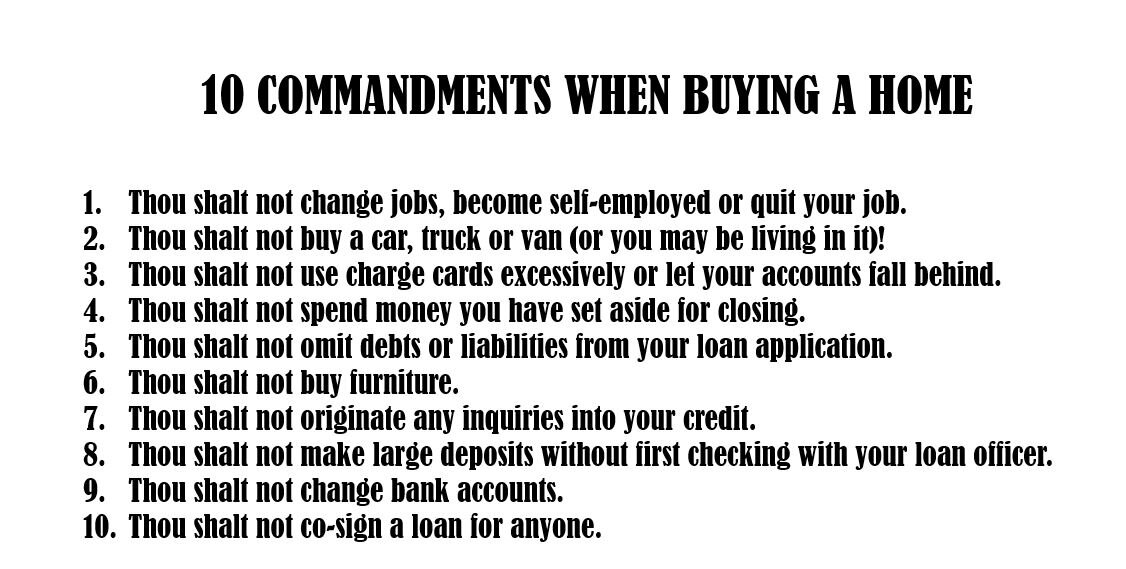

I have advised my buyers to abide by the Buyer Commandments for when they are in contract – at this point, it is ESPECIALLY important as a buyer to not make any major purchases or financial decisions that would impact credit score. A sudden or dramatic change in a credit score at this point could cause the lender to withdraw approval and send the loan application back to underwriting to re-evaluate- failure to get approved, or to close on time would cause the buyers to be in breech of contract and cost them both the house as well as possible legal fees.

We are ALMOST there, but we can’t celebrate quite yet!